As Seen On

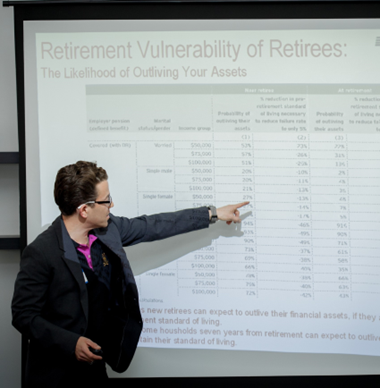

Bradley is honored to have been selected as one of the few Atlanta area educational speakers for the Society of Financial Awareness.

Learn More

Our Mission: Your Financial Confidence

Imagine you're about to board a plane heading to the vacation of your dreams. As the gate opens, the pilot announces they have no flight plan, and as a result, there's only a 50% chance of making it to your destination—do you still get on the plane? Would it surprise you to know that 50% of Baby Boomers and pre-retirees are the same about their retirement—and take the risk anyway? 1

Bradley Rosen founded Longevity Financial because he believes this level of risk is simply unacceptable. No one should ever outlive their retirement savings, but to make sure you have what you need to get you to where you're going, you need a strong flight plan to get you there. After decades in the financial industry, Bradley created his “Design for Life Retirement Plan” to help guide his clients to and through their retirement with longevity, prosperity, and confidence.

Design for Life Retirement Plans

No matter if you’re retired, preparing to retire, or have years to go, we’ll craft a customized plan that addresses your specific goals, risks, and dreams.

Ongoing Education

Financial literacy is the key to lasting financial peace. We aim to educate and inform our clients so they feel just as confident in their custom retirement plans as we do.

The Longevity Approach

As an independent financial advisory firm, we uphold the highest standards of fiduciary care, meaning we place our clients’ well-being as the first and only priority.

Testimonials

The above statements are provided from clients of the advisor. There has been no compensation paid of any type or kind in exchange for the statements. No material conflicts of interest exist arising from the relationship between the advisor and the clients. The statements provided may not be indicative of all client experiences. There can be no performance guarantees or guarantees of success.

Resources

Long-Term Care Planning

Investment Portfolios Facing Volatile Markets

Got Employer-Sponsored Life Insurance?

2024 Tax Planning Steps

4 Ways Annuities